Home > All journals > Intertax > 53(5 [pre-publication]) >

Jarrod Hepburn, Sunita Jogarajan

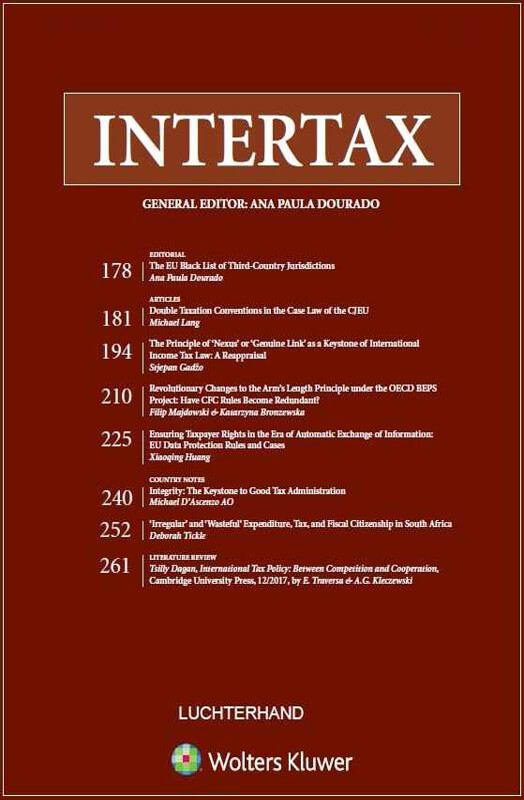

Intertax

Volume 53, Issue 5 [pre-publication] (2025) pp. 1 – 15

Abstract

To assist in the introduction and operation of the global minimum tax, the OECD’s supplementary material includes a rule which would likely result in a multinational entity paying tax in another jurisdiction on income earned in a particular source jurisdiction where the entity launches a legal challenge against the source jurisdiction’s minimum tax. In effect, this rule (intentionally) discourages taxpayers from using either domestic or international law to challenge the imposition of a minimum tax, by making the challenge economically unviable. Some commentators have queried whether the jurisdictions that adopt this rule may commit a denial of justice under customary international law, by impeding or discouraging taxpayers’ resort to rights of access to domestic courts and international arbitration tribunals constituted under international investment agreements (IIAs). This paper concludes, however, that such a rule would likely not amount to a denial of justice in so far as it discourages claims to either domestic courts or international tribunals. As such, this paper removes one potential obstacle for countries – particularly developing countries – in implementing the OECD’s minimum tax rules, even if other obstacles may remain.

Keywords

global minimum tax, GloBE rules, top-up tax, denial of justice, customary international law

Extract